kitfort-pro.ru

Gainers & Losers

What Is The Best Handheld Milk Frother

PERFECTLY FROTHED MILK IN SECONDS- Are you serious when it comes to your coffee? Then this handheld milk frother is perfect for all of your coffee drink. Nespresso Creatista Plus: This espresso machine uses beans and has a milk frother that can make latte art and gives a variety of milk frothing. Get barista-quality froth with the Zulay Kitchen Milk Frother. Delivers perfect foam in seconds - for creamy cappuccinos, lattes, and more. Get perfect foam for your coffee, cappuccino or latte with Salter's sleek handheld milk frother, complete with a double coil whisk for effortless. This is THE best handheld electric milk frother, you need it in your life. We have all used the flimsy ones which break quickly, leaving you wondering "are. Top Rated · Aerolatte Mooo Milk Frother in Black & White, Batteries/Travel Case Included · Norpro Deluxe Cordless Mini Mixer 5-Piece Set Whip Stir Blend Beat Mix. yep, that's my exact thought with the bodum. seems perfect for a cup or two of matcha, or for whipping cream or milk. We recommend the Aerolatte Original Hot and Cold Milk Frother, the PowerLix Milk Frother Handheld Battery Operated, or the Bodum Latteo Milk. If you're looking the best handheld milk frother in the UK then check out PowerLix's handheld whisk and frother. PowerLix milk frothers. PERFECTLY FROTHED MILK IN SECONDS- Are you serious when it comes to your coffee? Then this handheld milk frother is perfect for all of your coffee drink. Nespresso Creatista Plus: This espresso machine uses beans and has a milk frother that can make latte art and gives a variety of milk frothing. Get barista-quality froth with the Zulay Kitchen Milk Frother. Delivers perfect foam in seconds - for creamy cappuccinos, lattes, and more. Get perfect foam for your coffee, cappuccino or latte with Salter's sleek handheld milk frother, complete with a double coil whisk for effortless. This is THE best handheld electric milk frother, you need it in your life. We have all used the flimsy ones which break quickly, leaving you wondering "are. Top Rated · Aerolatte Mooo Milk Frother in Black & White, Batteries/Travel Case Included · Norpro Deluxe Cordless Mini Mixer 5-Piece Set Whip Stir Blend Beat Mix. yep, that's my exact thought with the bodum. seems perfect for a cup or two of matcha, or for whipping cream or milk. We recommend the Aerolatte Original Hot and Cold Milk Frother, the PowerLix Milk Frother Handheld Battery Operated, or the Bodum Latteo Milk. If you're looking the best handheld milk frother in the UK then check out PowerLix's handheld whisk and frother. PowerLix milk frothers.

Our Handheld Milk Frother is designed to froth both milk and matcha. It has a USB-rechargeable battery and features a detachable, two-layered whisk head. Milk Frothers & Steamers in Coffee Shop(+) · BCOOSS Electric Milk Frother Handheld for Coffee Portable Rechargeable Mixer Foam Maker Black · Mainstays Milk. Peach Street Powerful Handheld Milk Frother, Mini Frother Wand, Battery Operated Stainless Steel Mixer, With Stand. for Milk, Latte. It's time to whip up your best homemade latte ever! With a USB rechargeable handheld milk frother wand, you can create perfect latte foam over and over again. Zulay Kitchen Powerful Milk Frother Wand - Ultra Fast Handheld Drink Mixer - Electric Whisk Foam Maker for Coffee, Lattes, Cappuccino, Frappe, Matcha, Hot. Reviews (0). Reviews. There are no reviews yet. Be the first to review “Portable handheld milk frother with stainless steel head – 30 MYP” Cancel reply. Your. Make perfect coffee drinks, hot chocolates or even blended cocktails with our stainless teel milk frother. Conveniently cordless and battery powered. With this slim battery powered Handheld Milk Frother from The Coffee Bean & Tea Leaf, easily make delicious foam for lattes, cappuccinos and mochas at home. It's retro and remarkable, and if you have the budget for it, the Smeg milk frother is worth the counter space. Specs: Price: $ Style: Electric. Heating. Powerful Milk Frothier Handheld with Upgraded Holster Stand - White. Experience frothing at home like never before with the milk boss frothier. You can now. Handheld Milk Frother (USB Rechargeable), KF · QUICKLY CREATE THICK, LUXURIOUS FOAM. This frother for coffee helps you create silky lattes and cappuccinos in. The ElitaPro Double Whisk and Elementi Frother are the best performers in this metric. The same power that can make these frothers more challenging to control. The Kaffe handheld portable milk frother wand is your quickest route to a delicious coffee-shop style coffee, latte, cappuccino, macchiato or hot chocolate. Powerful Handheld Milk Frother This high-speed milk frother is the last tool you'll need to turn your homebrew from 'meh' to 'DREAMY'. Nothing hits the spot. The Cafe Casa 2 Speed Handheld Milk Frother took top honors in our testing and review of milk frothers. While other models could match the speed and cost of the. Create frothy drinks right from your home with Unicorn Superfoods Handheld Milk Frother which can be used for coffee, lattes, hot chocolate and superfood. The milk foam maker is perfect for making amazing cappuccino, latte, Nespresso, macchiato, milkshake, and other coffee recipes. LELIT Milk Jug with Latte Art Pen. Philips Baristina Milk Frother. Aerolatte Handheld Milk Frother. SMEG Milk Frother. Nespresso Aeroccino 4 Milk. Powerful Milk Frother Handheld Foam Maker, Mini Whisk Drink Mixer for Coffee, Cappuccino, Latte, Matcha, Hot Chocolate. Shop Crate & Barrel Handheld Electric Milk Frother. Our signature stainless steel frothing wand transforms milk into rich, creamy froth.

20 000 Loan Over 3 Years

The Personal Loan Calculator can give concise visuals to help determine what monthly payments and total costs will look like over the life of a personal loan. By the time a car is 2 or 3 years old, the previous owner will have already absorbed most of the vehicle's depreciation value, which translates to a better deal. Use the Loan Calculator to determine your regular payments, along with the total loan amount (principal and interest), and see how increasing your payments. 25 years in all other cases. If your down payment is more than 20% of your home's price, your lender sets your maximum amortization period. Why apply for a Personal Loan? slide 1 of 3. Borrow up to $50, up front. Have money available for major purchases, unexpected bills, investments and more. 20 years. -1 month faster. 3 check This reduced your mortgage length by. 4 years, 3 months. Amortization graph. Amortization graph. Amortization schedule. Our Loan Calculator helps to determine the amount you can borrow and what your repayment schedule might be. More frequent payments will reduce your total interest over the term of your loan. I'll pay it off in. 3 years, 4 years, 5 years. The time you take to pay it. Calculate your loan payments with our easy-to-use calculator. Get instant results and find out what your payments could look like. The Personal Loan Calculator can give concise visuals to help determine what monthly payments and total costs will look like over the life of a personal loan. By the time a car is 2 or 3 years old, the previous owner will have already absorbed most of the vehicle's depreciation value, which translates to a better deal. Use the Loan Calculator to determine your regular payments, along with the total loan amount (principal and interest), and see how increasing your payments. 25 years in all other cases. If your down payment is more than 20% of your home's price, your lender sets your maximum amortization period. Why apply for a Personal Loan? slide 1 of 3. Borrow up to $50, up front. Have money available for major purchases, unexpected bills, investments and more. 20 years. -1 month faster. 3 check This reduced your mortgage length by. 4 years, 3 months. Amortization graph. Amortization graph. Amortization schedule. Our Loan Calculator helps to determine the amount you can borrow and what your repayment schedule might be. More frequent payments will reduce your total interest over the term of your loan. I'll pay it off in. 3 years, 4 years, 5 years. The time you take to pay it. Calculate your loan payments with our easy-to-use calculator. Get instant results and find out what your payments could look like.

Based on a €20, fixed rate loan over 5 years, the monthly repayments would be € The rate would be % fixed nominal interest rate. The Annual. Save on higher-rate debt with a fixed interest rate from % to % APR. Flexible Terms. Borrow up to $40, and repay it over 3 to 7 years —. 36 months (3 years), 48 months (4 years), 60 months (5 years). Enter Interest : The total interest you pay over the life of the loan. Borrowers with. Interest rate: %; Loan term: 3 years. Check your results against ours: Monthly payment: $; Total interest: $4, Debt consolidation loan. Use this calculator for basic calculations of common loan types such as mortgages, auto loans, student loans, or personal loans. Not have been declared bankrupt in the last six years. Not have applied for a loan with us in the last 28 days. Car loans if you have a poor credit rating; Promotional financing offers; Relationships with Canadian banks to secure your best options. Interest rate: %; Loan term: 3 years. Check your results against ours: Monthly payment: $; Total interest: $4, Debt consolidation loan. But if you take out a $6, loan for seven years with an APR of 4%, your monthly payment will be $ Almost all personal loans offer payoff periods show. This includes your payments to interest which add up to $3, over the life of the loan. This calculator uses monthly compounding and monthly payment. LendingTree's personal loan calculator can help you see how much your loan could cost, including principal and interest. Apply when you're ready. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term. Borrow up to % of your school-certified expenses, whether you're studying online or on-campus.3; Add a cosigner. Last year, students were 4X more likely. 36 months (3 years), 48 months (4 years), 60 months (5 years). Enter Interest : The total interest you pay over the life of the loan. Borrowers with. Representative % APR, based on a loan amount of £10,, over 5 years, at a Fixed Annual Interest Rate of %, (nominal). This would give you a monthly. If you're taking out a year loan, the repayment term is months (12*10). Calculate the interest over the life of the loan. Add 1 to the interest rate. For example, if you know how much you can afford for a monthly payment over a certain number of months and you want to calculate how much money you might afford. Calculate your RRSP savings. Does it make sense to borrow to invest in your RRSP? See how much an RRSP loan investment applied to this year's tax return could. But if you take out a $6, loan for seven years with an APR of 4%, your monthly payment will be $ Almost all personal loans offer payoff periods show. If you're looking to pay off a loan of $20, over 7 years, and you get an interest rate of %, you'll be looking at monthly payments of $ Once.

How To Pay Off Charge Offs

If you need to remove an illegitimate charge-off or any incorrect information, you must file a dispute with the credit bureau that produced the report with the. A creditor will usually “charge off” a debt when a consumer fails to make monthly payments for six consecutive months, at which point the account is closed. Settling a charged-off debt means that you negotiate with the creditor to pay a portion of the outstanding balance, and they agree to forgive. In some cases, paying the charged-off account will show a positive impact to your credit score by eliminating excessive utilization. Seek the advice of a. Graph and download economic data for Charge-Off Rate on Credit Card Loans, All Commercial Banks (CORCCACBS) from Q1 to Q2 about charge-offs. You'll want to contact each credit reporting bureau to dispute the charge-off. How do I dispute charge-offs with the credit bureaus? There are two types of. You will still be responsible for paying off charged-off accounts until you have paid them, settled them with the lender, or discharged them through bankruptcy. Pay for Delete: Some creditors might be willing to remove the charge-off from your credit report if you pay the outstanding debt. This is known as a “pay for. Your first option is to request the charge-off be removed from your credit report in exchange for agreeing to pay the debt. You can either pay in full or set up. If you need to remove an illegitimate charge-off or any incorrect information, you must file a dispute with the credit bureau that produced the report with the. A creditor will usually “charge off” a debt when a consumer fails to make monthly payments for six consecutive months, at which point the account is closed. Settling a charged-off debt means that you negotiate with the creditor to pay a portion of the outstanding balance, and they agree to forgive. In some cases, paying the charged-off account will show a positive impact to your credit score by eliminating excessive utilization. Seek the advice of a. Graph and download economic data for Charge-Off Rate on Credit Card Loans, All Commercial Banks (CORCCACBS) from Q1 to Q2 about charge-offs. You'll want to contact each credit reporting bureau to dispute the charge-off. How do I dispute charge-offs with the credit bureaus? There are two types of. You will still be responsible for paying off charged-off accounts until you have paid them, settled them with the lender, or discharged them through bankruptcy. Pay for Delete: Some creditors might be willing to remove the charge-off from your credit report if you pay the outstanding debt. This is known as a “pay for. Your first option is to request the charge-off be removed from your credit report in exchange for agreeing to pay the debt. You can either pay in full or set up.

You can negotiate a settlement to a credit card debt before the credit card issuer moves the debt to a charge-off status. The VA does not require charge-offs and collection accounts to be paid off. The underwriter should obtain the Veteran's explanation and supporting. The initial agreement between yourself and the creditor · A transfer of debt ownership to a third-party collection agency (if applicable) · Your payment history. Usually, creditors charge off a debt about six months after you stop making payments on the account. Accounts Placed in Collection. If your account is placed in. Negotiate a pay for delete charge-off agreement. If your debt is still with the original lender, you can ask to pay the debt in full in exchange for the charge-. My loan was charged off. So why is the bank still requiring payment? When a bank charges off a loan, it is an accounting procedure. It does not eliminate your. Preventing Charge-offs Loans are not charged off for late payments until they are days past due. Affirm provides notices of late payments and the. Charge-off is an accounting term which means the creditor believes a debt (money owed) can't be collected. Payment Systems · Economic Research & Data · Consumer Information · Community Charge-offs are the value of loans and leases removed from the books and. The Implication of Paying Charge-offs in Full When you pay the full charge-off balance, the account's status on your credit report will be updated to show. If the charged-off debt is yours, you are legally responsible for paying it. You have some options for doing so. If the original creditor has not sold the. A charge-off allows the lender to decrease the amount of a loan. If they have a borrower who is not making their payments, the lender may choose to lower the. This occurs when a consumer becomes severely delinquent on a debt. Traditionally, creditors make this declaration at the point of six months without payment. A. The only way to avoid a charge-off is by getting help before it's too late - before the account actually charges off. It may seem daunting, especially if you. All accounts in third party collections are charge offs, except for certain medical bills which are placed pre charge off. Charge-offs are debts that cannot be collected and are written off by the lender. Any debt overdue ( days for loans, days for credit card debt) must be. Many people confuse a charge-off with the debt being forgiven. If your debt has been forgiven, you do not have to repay it. However, a charge-off means the. A charge-off allows the lender to decrease the amount of a loan. If they have a borrower who is not making their payments, the lender may choose to lower the. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and.

Most Reliable Term Life Insurance Company

Term life insurance helps protect the financial future of Canadian families. Term insurance is very affordable and easy to buy online. Calculate your life. Independent rating agencies like AM Best, Fitch, and Moody's asses the financial strength and stability of an insurance company, as well as its ability to meet. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. Progressive Life Insurance Company also offers term life policies that don't require a medical exam. Comparing term and whole life insurance. Term and whole. * The product quoted is the Protective® Classic Choice Term (ICCTL21 / TL) a term life insurance policy issued by Protective Life Insurance Company. Term insurance companies won't offer year-olds year policies Once you reach 90, most insurance companies won't issue you a life insurance policy. Amica. Amica has been in business since and offers term and whole life insurance. It's highly rated for financial strength with an A+ A.M. Best rating. Quality term life insurance from a premier life insurance carrier. Protect your family or business for the term period of your choosing at competitive premiums. Pacific Life is the best life insurance company of , based on our analysis. The best life insurance companies offer a range of policies, including term and. Term life insurance helps protect the financial future of Canadian families. Term insurance is very affordable and easy to buy online. Calculate your life. Independent rating agencies like AM Best, Fitch, and Moody's asses the financial strength and stability of an insurance company, as well as its ability to meet. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. Progressive Life Insurance Company also offers term life policies that don't require a medical exam. Comparing term and whole life insurance. Term and whole. * The product quoted is the Protective® Classic Choice Term (ICCTL21 / TL) a term life insurance policy issued by Protective Life Insurance Company. Term insurance companies won't offer year-olds year policies Once you reach 90, most insurance companies won't issue you a life insurance policy. Amica. Amica has been in business since and offers term and whole life insurance. It's highly rated for financial strength with an A+ A.M. Best rating. Quality term life insurance from a premier life insurance carrier. Protect your family or business for the term period of your choosing at competitive premiums. Pacific Life is the best life insurance company of , based on our analysis. The best life insurance companies offer a range of policies, including term and.

A term life insurance policy is an agreement between you and a life insurance company Most term life policies have no face value once the term ends. At Aflac, our plans are competitive and reliable. We'll work with you to find the term length that makes the most sense. Try our life insurance calculator to. Looking for affordable, same-day life insurance? SelectQuote can help. Our no medical exam life insurance offers budget-friendly, fully underwritten rates. Get affordable protection with our trusted term life insurance policies most stable insurance companies in America. Get In Touch. S. Palafox st. Best term life insurance companies ; State Farm, Excellent customer service ratings, /1,, A++ (Superior), AA ; Mutual of Omaha, Easy online quoting for term. Life policies are underwritten by Bankers Life and Casualty Company (Chicago, IL), Colonial Penn Life Insurance Company (Philadelphia, PA) and in New York. Ask your insurance agent, financial advisor, or insurance company representative for an illustration showing future values and benefits. Most term policies have. Of the 28 life insurance companies we evaluated, our analysis determined that the best life insurance company is Pacific Life. We researched and compared. For most young people, term life insurance is popular because it's more affordable. Deciding which term length is best for you will depend on your age. Know the people you care for most are taken care of with reliable claims payouts. Insurance products are issued by: John Hancock Life Insurance Company. For those specifically seeking no-exam term life insurance, companies like Ladder, Ethos and Bestow primarily offer policies that do not require a medical exam. BMO Insurance: BMO provides affordable term life insurance options with flexible terms, backed by one of Canada's oldest and most trusted banks. Choosing these. most trusted life insurance companies in the nation. We'll take the time to get to know your situation, provide you with free, unbiased term life insurance. For complete details of the best plan for you and your family, talk to your company's benefits administrator or contact MetLife directly for more information. Term life insurance can be a great way to help protect your family's financial future. Transamerica offers several term life insurance policies suited just. Guaranteed acceptance whole life · TruStage™ Simplified Issue Term Life Insurance is issued by CMFG Life Insurance Company. This is a term policy to age 80 that. Most Trusted Financial Companies by Investor's Business Daily. Survey results are presented solely with respect to Primerica's U.S. term life insurance. The most popular life insurance is term life because it's flexible, affordable, dependable, and simple. It's usually the best place for hard-working families to. Term life insurance is the most cost-effective way to provide death benefit Life Insurance Company and Pruco Life Insurance Company of New Jersey. Colonial Penn offers affordable coverage options no matter where you are in life. Whether you're planning ahead, or haven't planned enough, we have options.

Paxos Trust Company Stock

The current price is $ per PAX with a hour trading volume of $M. Currently, Paxos Standard is valued at % below its all time high of $ International stock ticker · Swift/BIC codes · IBAN codes · Rate alerts · Compare exchange rates · Incorporate your company · Invoice generator · Business. Accredited investors can buy pre-IPO stock in companies like Paxos through EquityZen funds. These investments are made available by existing Paxos shareholders. The exchange house itBit, in alliance with Paxos, sells cryptocurrencies to PayPal. Dec 15, | kitfort-pro.ru Media icon. itBit Trust Company, LLC. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an. NYDIG Execution LLC, Virtual Currency and Money Transmitter Licenses, ; NYDIG Trust Company LLC, Limited Purpose Trust Charter, ; Paxos Trust. Paxos is a blockchain infrastructure platform created for trading, settling, and managing assets. Their itBit Exchange is built for asset trading for. Our solution holds user assets in bankruptcy-remote accounts through the Paxos Trust company and includes digital asset insurance. Licensing. Put regulation. Paxos is a privately held company. Therefore, it does not have a stock symbol or “ticker” that trades on public exchanges like the NYSE, Nasdaq, etc. Can. The current price is $ per PAX with a hour trading volume of $M. Currently, Paxos Standard is valued at % below its all time high of $ International stock ticker · Swift/BIC codes · IBAN codes · Rate alerts · Compare exchange rates · Incorporate your company · Invoice generator · Business. Accredited investors can buy pre-IPO stock in companies like Paxos through EquityZen funds. These investments are made available by existing Paxos shareholders. The exchange house itBit, in alliance with Paxos, sells cryptocurrencies to PayPal. Dec 15, | kitfort-pro.ru Media icon. itBit Trust Company, LLC. All digital asset transactions occur on the Paxos Trust Company exchange. Any positions in digital assets are custodied solely with Paxos and held in an. NYDIG Execution LLC, Virtual Currency and Money Transmitter Licenses, ; NYDIG Trust Company LLC, Limited Purpose Trust Charter, ; Paxos Trust. Paxos is a blockchain infrastructure platform created for trading, settling, and managing assets. Their itBit Exchange is built for asset trading for. Our solution holds user assets in bankruptcy-remote accounts through the Paxos Trust company and includes digital asset insurance. Licensing. Put regulation. Paxos is a privately held company. Therefore, it does not have a stock symbol or “ticker” that trades on public exchanges like the NYSE, Nasdaq, etc. Can.

In , Paxos became the first crypto-native company to receive preliminary approval for a de novo national Trust Bank charter. -. In October , in. What is Paxos (PAX)? The Paxos Standard Token (PAX) is a stablecoin managed by the Paxos Trust Company. PAX is directly tied to the US dollar in order to keep. PayPal USD is issued by Paxos Trust Company, LLC (Paxos). PayPal and Paxos are committed to ensuring the public availability of reports on the PayPal USD. Paxos-issued stablecoins are always backed with US dollar-denominated reserves, fully segregated and held in bankruptcy remote accounts. Paxos is the only. Company profile page for Paxos Trust Co LC including stock price, company news, executives, board members, and contact information. Issued by Paxos Trust Company, PayPal USD (PYUSD) is PayPal's stablecoin designed for payments. The Paxos Standard token is fully collateralized by the U.S. dollar, issued by the Paxos Trust Company, and approved and regulated by the New York State. The live Pax Dollar price today is $ USD with a hour trading volume of $ USD. We update our USDP to USD price in real-time. Interactive Brokers lets you trade four cryptocurrencies through Paxos Trust Company and Zero Hash, including Bitcoin and Ethereum, for one of the lowest. Find the perfect paxos trust company stock photo, image, vector, illustration or image. Available for both RF and RM licensing. Paxos Trust Company is a New York–based financial institution and technology company specializing in blockchain. Paxos Trust Company, LLC operates as a software company. The Company offers blockchain solutions such as tokenize, custody, trade, and settle assets. Paxos has raised $M over 8 rounds. Paxos's latest funding round was a Corporate Minority for on January 20, Paxos's valuation in April was. Learn then trade all on one app with Plynk Crypto. We've teamed up with Paxos Trust Co. to bring you a simplified trading experience. Security is crucial to cryptocurrency trading. Use the IBKR platform and funds from your IBKR account to trade cryptocurrencies at either Paxos Trust Company or. A digital token, backed by physical gold · Cost-efficient. Paxos offers PAXG at a lower cost structure than that of other gold tokens, gold ETFs and LBMA t. Paxos was the first virtual currency company to receive a charter from the New York State Department of Financial Services. As a chartered limited purpose trust. Paxos, a regulated Trust company, turned to Sovos to improve the tax stock or mutual fund trades to the IRS. Although IRS regulations on crypto. Paxos Trust Company, and withdraw cryptocurrency assets from your Paxos account to an external wallet. Trade stocks, options, futures (including. Issued by Paxos Trust Company, PayPal USD (PYUSD) is PayPal's stablecoin designed for payments.

Peppermint Legal Software

Peppermint Technology is a leading UK cloud software company offering the legal sector an opportunity to transform how they do business. We are a cloud software company offering the legal sector an opportunity to transform how they do business. Peppermint Technology Logo. Contact Peppermint. Designed uniquely for legal firms and legal businesses, Peppermint's Client Engagement CRM SaaS cloud-based software, is helping to deliver real commercial and. Peppermint's strategy allows firms who wish to embrace the full value of the Peppermint CX Cloud Platform, and its single data source, to do so in a phased. Peppermint is a legal software company dedicated to exclusively helping large law firms transform how they do business. Peppermint Technology is a cloud software company focused on the legal sector. Its platform provides the full suite of legal applications. by Peppermint Technology Limited · An application that empowers law firms to do more in Microsoft , Microsoft Teams and Outlook. Nottingham-based Peppermint Technology pioneers a cloud-based software platform that can transform the way legal service providers automate their operations. Peppermint Technology is a leading UK cloud software company offering the legal sector an opportunity to transform how they do business. Peppermint Technology is a leading UK cloud software company offering the legal sector an opportunity to transform how they do business. We are a cloud software company offering the legal sector an opportunity to transform how they do business. Peppermint Technology Logo. Contact Peppermint. Designed uniquely for legal firms and legal businesses, Peppermint's Client Engagement CRM SaaS cloud-based software, is helping to deliver real commercial and. Peppermint's strategy allows firms who wish to embrace the full value of the Peppermint CX Cloud Platform, and its single data source, to do so in a phased. Peppermint is a legal software company dedicated to exclusively helping large law firms transform how they do business. Peppermint Technology is a cloud software company focused on the legal sector. Its platform provides the full suite of legal applications. by Peppermint Technology Limited · An application that empowers law firms to do more in Microsoft , Microsoft Teams and Outlook. Nottingham-based Peppermint Technology pioneers a cloud-based software platform that can transform the way legal service providers automate their operations. Peppermint Technology is a leading UK cloud software company offering the legal sector an opportunity to transform how they do business.

Built on the Microsoft Dynamics Industry Application Platform, Peppermint CX provides a full suite of legal service applications designed to support high. Check Peppermint software market share in , top Peppermint technology alternatives & competitors in Legal Vertical Software & customer insights. Pinnacle has announced a partnership agreement with cloud-based legal software specialist Peppermint Technology, as it looks to help clients get more out of. Overview. Peppermint Technology is a company that develops a legal management software for law firms. It offers CX, a platform featuring client engagement. Peppermint CX is a pre-configured, easy to use, modern legal software platform. Designed and built on the award winning Microsoft Dynamics and SharePoint. Peppermint are a legal software company dedicated to exclusively helping large law firms transform how they do business. Which Legal Management software is better? Legal CRM is more expensive but offers some extra features. Compare inside pricing, pros, and cons. Peppermint is one of the easy to use text editor software. This us Available Artificial Intelligence Impact on the Legal Industry · Best Photo. Peppermint CX is a cloud-based, all-in-one legal service system: CRM, financials, case & practice management – all delivered through a client centric lens. As the leading Microsoft Independent Software Vendor for legal, Peppermint provides modular legal applications to law firms in the UK and North America that. Our mission is to be the market leader in front office saas applications to large law, uniquely positioned as Microsoft's key global partner. As the leading Microsoft Independent Software Vendor for legal, Peppermint provides modular legal applications to law firms in the UK and. Effective email and document security software Peppermint Technology. View Website Contact Sales. About. Born in legal, built on Microsoft, Live in the Cloud. As the leading Microsoft Independent Software Vendor for legal, Peppermint provides modular legal applications to law firms that are proven to deliver. CX provides a modular choice of easy-to-use, innovative, and modern legal Peppermint Software is built on the Microsoft Power Platform. The service. The Platform is a new generation end-to-end business platform for legal providers built on Microsoft Dynamics CRM that comprises: Applications. Peppermint Technology is an innovative cloud software provider that exclusively serves the legal market. As the leading Microsoft Independent Software. Our solution is a legal layer built on the Microsoft Power. Platform and Microsoft Dynamics This means. Peppermint Client Engagement seamlessly fits into. {tab=Company profile}Peppermint Technology is a leading cloud software company offering the legal sector an opportunity to transform how they do business. Learn what software and services integrate with Peppermint CX Enterprise Legal Management (ELM) Law Practice Management Legal Case Management Legal.

Kinecta Savings Interest Rate

Today's Rate ; %, %, % ; %, %, % ; %, %, %. Kinecta Federal Credit Union Checking Plus has an annual percentage yield of up to %, which is higher than the national average interest rate on savings. Kinecta Federal Credit Union Savings Account Rates ; %, $0, -, Health Savings Account - Family, View Details - ; %, $5, -, Regular Share Account, View. Kinecta borrowers perceived this savings account to be a sign that the credit union cared about its customers and had their best interests in mind. 10 For. interest rate on funds deposited for a specified period of time. Bank savings accounts and CDs are FDIC insured up to $, per depositor per institution. Rates are accurate as of 09/01/ The standard variable APR (Annual Percentage Rate) for Purchases and Balance Transfers is % - % (minimum of $ For a limited time, % APR * balance transfers 1 for 18 months. Pay off higher-rate credit cards from other institutions with no transfer fee. After the. *Account must be funded with new money to the bank. Pros. Lowest minimum deposit requirement among rate leaders. Cons. Rate good only on deposits. Membership requirements: Anyone is eligible to apply for PenFed membership. All you need is to open and maintain a savings account balance of at least $5. Today's Rate ; %, %, % ; %, %, % ; %, %, %. Kinecta Federal Credit Union Checking Plus has an annual percentage yield of up to %, which is higher than the national average interest rate on savings. Kinecta Federal Credit Union Savings Account Rates ; %, $0, -, Health Savings Account - Family, View Details - ; %, $5, -, Regular Share Account, View. Kinecta borrowers perceived this savings account to be a sign that the credit union cared about its customers and had their best interests in mind. 10 For. interest rate on funds deposited for a specified period of time. Bank savings accounts and CDs are FDIC insured up to $, per depositor per institution. Rates are accurate as of 09/01/ The standard variable APR (Annual Percentage Rate) for Purchases and Balance Transfers is % - % (minimum of $ For a limited time, % APR * balance transfers 1 for 18 months. Pay off higher-rate credit cards from other institutions with no transfer fee. After the. *Account must be funded with new money to the bank. Pros. Lowest minimum deposit requirement among rate leaders. Cons. Rate good only on deposits. Membership requirements: Anyone is eligible to apply for PenFed membership. All you need is to open and maintain a savings account balance of at least $5.

I would definitely recommend Doug to my friends & family in the future! Loan StatusClosed Sep Loan TypePurchase. Interest Rate. What is CD interest rate? Hello Antoine, thank you for your question. For our most current CD rates, you may visit our website, kitfort-pro.ru View. Enter the purchase price, monthly payment, down payment, term and interest rate to see how different loan terms or down payments can impact your monthly payment. Instead, we help make your financial journey unique to you – that starts with education. Learn More. checking account, piggy bank, checking account columbus ga. Mortgage Loans 6. Whether you're buying a new home or refinancing your current home, a Kinecta Mortgage Loan Consultant can help provide the right financing. USD. USD. Connected bank account (ACH) fee. USDOur fee. –. USDTotal fees. = USDTotal amount we'll convert. ×. Guaranteed rate (31h). Rates are tiered and generally very good for Kinecta's certificates. The APY for the one year regular certificate is %, with lower rates for shorter terms. Kinecta MyPower Mastercard® · % Intro APR on Balance Transfers of minimum $ when requested within 90 days of account opening. · Liability protection for. account that can meet your unique needs. Ask for a Rate Reduction - Carrying a credit card balance? You may get an interest rate reduction by calling your. 3) Poor savings interest rates: They used to offer better rates than the big banks but no longer do. 4) Ease of doing business: Everything is difficult with. Deposit Rates - August 16, ; 12 Mo CD. %, $, ; 24 Mo CD. %, $ ; 24 Mo CD. %, $, ; 36 Mo CD. %, $ Kinecta Personal Line of Credit offers: · Draw funds as needed at a variable interest rate · Unsecured — no collateral required · Credit limits from $1, to. Minimum deposit requirement: %; Compound interest schedule: %; Availability: 5%; Available terms: 5%. CD accounts with higher APYs rose to the top of. What is CD interest rate? Hello Antoine, thank you for your question. For our most current CD rates, you may visit our website, kitfort-pro.ru View. I think chase pays % interest on their savings. I almost hate to tell her that most places offer a higher interest rate than Kinecta's. Kinecta Federal Credit Union currently offers two liquid certificates. The 9-month liquid certificate pays a robust % APY, but you need to deposit $10, Saving you money at closing and over the life of your loan. As a Kinecta member, we're pleased to offer you discounts on your mortgage interest rate and. $. Months. Current Savings $. Monthly Savings $. Interest Rate %. BANKING DONE DIFFERENT. Kinecta delivers everything you'd expect. interest in helping me find the solutions that best fit my needs. Jessica's rate. A gentleman by the name of Janaka is always very courteous when.

How To Get Best Interest Rate Mortgage

Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Get access to over 50 lending partners with one phone call · No surprises! · We're on your side and committed to finding you the best deal with the best lender. Comparing rates from different lenders is essential to ensure that you secure the most competitive interest rate. Obtain rate quotes from multiple lenders and. You'll most likely find a lower interest rate if you do your homework and are willing to negotiate. Remember, you have a choice of lenders—large banks; smaller. Consider more than just the rate: Consider factors beyond the interest rate, such as closing costs, fees, and loan terms. The best rate might come with higher. Compare today's mortgage rates and get a customized quote from a lender that fits your needs The year fixed mortgage rate on September 10, is. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. How to get the best interest rate on a mortgage · Minimising risk · Loan-to-value (LTV) · Credit history · Affordability and debt to income ratio · Joint. 1. Increase your credit score. Your credit score has the greatest impact on the mortgage interest rate you're offered. Generally, a higher credit score entitles. Mortgage rates today · yr fixed. Rate. %. APR. %. Points (cost). ($3,). Term. yr fixed. Rate · yr fixed FHA. Rate. %. APR. %. Get access to over 50 lending partners with one phone call · No surprises! · We're on your side and committed to finding you the best deal with the best lender. Comparing rates from different lenders is essential to ensure that you secure the most competitive interest rate. Obtain rate quotes from multiple lenders and. You'll most likely find a lower interest rate if you do your homework and are willing to negotiate. Remember, you have a choice of lenders—large banks; smaller. Consider more than just the rate: Consider factors beyond the interest rate, such as closing costs, fees, and loan terms. The best rate might come with higher. Compare today's mortgage rates and get a customized quote from a lender that fits your needs The year fixed mortgage rate on September 10, is. Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation. How to get the best interest rate on a mortgage · Minimising risk · Loan-to-value (LTV) · Credit history · Affordability and debt to income ratio · Joint. 1. Increase your credit score. Your credit score has the greatest impact on the mortgage interest rate you're offered. Generally, a higher credit score entitles.

Choose a few mortgage lenders to shop with. · Compare rates on different types of mortgages. · Consider less-common rates and terms. · Get loan estimates to. Different lenders will offer you different terms, which is why it's important to get quotes from more than one lender, compare your options and ask questions. If you are shopping for a mortgage, the fastest way to shop for interest rates is to call up a few mortgage brokers and ask them. Not all mortgage brokers are. While fixed-rate mortgages have a set interest rate that doesn't change over the life of the loan, variable-rate mortgages have an interest rate that can. 7 ways to get a lower mortgage rate · 1. Shop for mortgage rates · 2. Improve your credit score · 3. Choose your loan term carefully · 4. Make a larger down payment. Home Financing Advisors may also work to offer a more favourable rate than what is in your current mortgage terms. In this scenario, an advisor may help you. Most federally sponsored programs allow lenders who have fair or good credit scores to qualify for home loans even if they don't meet all traditional metrics. Offers a one-day mortgage that lets eligible borrowers apply, lock in a rate and get a loan commitment within 24 hours. Average interest rates are on the low. How Do I Get the Best Mortgage Rate? · Get a consistent, fixed-rate mortgage so your interest rate will not fluctuate over the life of the loan. · Take advantage. The next step in comparing mortgage rates is to get preapproved with a handful of lenders. In most cases, this will impact your credit scores. However, multiple. If you're looking to refinance your current mortgage, today's national average year fixed refinance interest rate is %, falling 11 basis points from a. 1. Give your credit score a boost Improving your credit score is one of the best things you can do to improve your interest rate. It also can increase your. Get quotes from three or more lenders so you can see how they compare. Rates often change from when you first talk to a lender and when you submit your mortgage. What to do to get the best deal on your mortgage · 2. Watch out for hidden discount points and fees. The interest rate is only one part of the equation when you'. Bank of America is the best overall option for many existing homeowners and first-time homebuyers since they offer many fixed-rate, low-down-payment, and. The more cash you put toward the home, the better the interest rate you could get. A low down payment increases the lifetime cost of your mortgage. The more. You can choose a fixed rate or an adjustable rate, and fixed rates sound great, but they are called a “closed-end instrument” and require the borrower to take. Compare accurate and up-to-date fixed and variable mortgage rates from Get the security of a fixed interest rate and the flexibility to pay off as. There are many ways you can get your lowest home loan interest rates: Boost your credit score to or higher. You'll need to aim for a credit score to. Generally speaking, borrowers with credit scores of or higher get charged the lowest interest rates.

Best Credit Cards For Low Fico Scores

Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Get Your FICO® Score · Learn About Credit · Respond to a Mail Offer · View Sample. Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it. Capital One Quicksilver Secured Cash Rewards Credit Card · FIT™ Platinum Mastercard - $ Credit Limit · Credit One Bank Secured Card · Credit One Bank American. In summary, the Discover it® Secured Credit Card offers a powerful combination of credit-building benefits and cashback rewards. With its low initial deposit. Check your credit score. Discover shows your FICO® Credit Score9 for free, so you can track it. · Apply for the Discover it® Secured Card · Pay credit bills on. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. The Discover it® Secured Credit Card is our pick for the best credit card for bad credit, since it's easy to get approved for, offers cash back and provides. Some of our picks ; Rewards. AvantCard logo. AvantCard ; Cash back. Credit One Bank® Secured Card logo. Credit One Bank® Secured Card ; Intro bonus. Delta SkyMiles. Best for limited credit: Capital One Platinum Credit Card. Here's why: The Capital One Platinum Credit Card can help you establish a positive credit history. Low Intro Interest Rate Credit Cards · No Foreign Transaction Fee Credit Get Your FICO® Score · Learn About Credit · Respond to a Mail Offer · View Sample. Keep balances low on credit cards and other revolving credit: high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it. Capital One Quicksilver Secured Cash Rewards Credit Card · FIT™ Platinum Mastercard - $ Credit Limit · Credit One Bank Secured Card · Credit One Bank American. In summary, the Discover it® Secured Credit Card offers a powerful combination of credit-building benefits and cashback rewards. With its low initial deposit. Check your credit score. Discover shows your FICO® Credit Score9 for free, so you can track it. · Apply for the Discover it® Secured Card · Pay credit bills on. Excellent: ; Good: ; Fair: ; Poor: ; Very Poor: FICO credit score. The Discover it® Secured Credit Card is our pick for the best credit card for bad credit, since it's easy to get approved for, offers cash back and provides. Some of our picks ; Rewards. AvantCard logo. AvantCard ; Cash back. Credit One Bank® Secured Card logo. Credit One Bank® Secured Card ; Intro bonus. Delta SkyMiles. Best for limited credit: Capital One Platinum Credit Card. Here's why: The Capital One Platinum Credit Card can help you establish a positive credit history.

Best for Overall: Discover it® Secured Credit Card. Why we love this card: While rewards shouldn't be your top priority when choosing a credit-building card. Petal® 2 “Cash Back, No Fees” Visa® Credit Card *: Best unsecured card for bad credit. Capital One Platinum Credit Card: Best for building credit. Petal® 1 “No. Travel cards with premium benefits typically require a good or excellent credit score to qualify. · The Capital One Platinum Secured has a $0 annual fee and no. Top-tier or "excellent" credit starts around and gives you a good chance of being approved for credit cards and other loans. Your credit score is. The DCU Visa® Platinum Secured Credit Card is a secured card for bad credit, but it offers a lower interest rate than many unsecured cards for people with good. FICO Scores (the most widely used scoring model) range from to - Poor; - Fair; - Good; - Very Good; +: Excellent. Capital One Platinum Credit Card · Fortiva® Mastercard® Credit Card · PREMIER Bankcard® Mastercard® Credit Card · Destiny Mastercard® – $ Credit Limit · Capital. Don't close old credit card accounts or apply for too many new ones. You can sign up for credit monitoring services quickly, and they will help you keep on top. score and put you on a path to improve your financial quality of life. Elevating a FICO score into the fair or good range opens borrowing opportunities. Credit Cards for Bad Credit / Rebuilding Credit Score · Self - Credit Builder Account with Secured Visa® Credit Card · Revenued Business Card · OpenSky® Plus. In most cases, a secured credit card is the best option for someone with bad credit because secured cards are easier to get and much less expensive in the long. Then, your search is over. These credit cards for bad credit are designed for lower credit scores. Find the right card now FICO® Score · What Is a Good Credit. If you prefer a secured credit card with a low deposit requirement, this card is a good choice. With responsible card use – including on-time payments – you can. Secured credit cards tend to be a good option for those looking to build or rebuild their credit. And with consistent, responsible use, you can improve your. Good builder/rebuilder cards are Discover and Capital One. Both creditors offer pre-approval tools that won't require a hard pull prior to. The best travel and cash-back cards typically require a good to excellent score, while the Discover it Secured Credit Card is designed for those with bad credit. Credit cards for good credit require a FICO score between to When used responsibly, they will help you grow your score and provide access to premium. Click APPLY NOW to apply online · New feature! · No credit check to apply. · Looking to build or rebuild your credit? · Get free monthly access to your FICO score. With 15+ years of experience reporting on credit cards, we've selected the Capital One QuicksilverOne Cash Rewards Credit Card as the best credit card for fair.

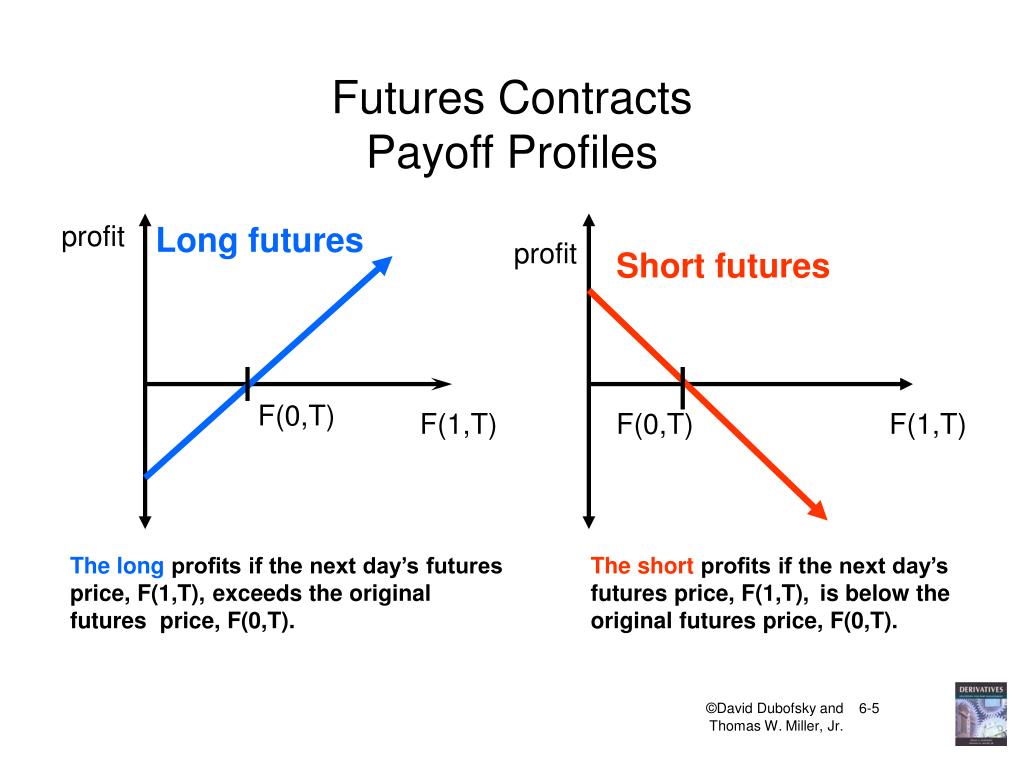

Futures Forward

Like forward contracts, the futures price is established so that the initial value of a futures contract is zero. Unlike forward contracts, futures contracts. Futures and forwards are both derivatives, and a derivative is a financial product, instrument or contract whose value or price is derived from the price of. To learn the functions of futures and forwards contracts. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is. Differentiate between forward and futures contracts in derivative markets, examining their features, risk profiles, and regulatory supervision to assist. A forward contract on an asset is an agreement between the buyer and seller to exchange cash for the asset at a predetermined price (the forward price) at a. A forward contract is a customized contract between two parties to buy or sell an asset at a specified price on a future date. Learn how to price and value swaps, futures, and forward contracts with CFA Institute. Understand the formulas needed for forward commitment valuation. The value of an OTC futures contract is based on the listed asset's price on the underlying exchange. For forwards, we create prices synthetically, considering. Like forward contracts, the futures price is established so that the initial value of a futures contract is zero. Unlike forward contracts, futures contracts. Futures and forwards are both derivatives, and a derivative is a financial product, instrument or contract whose value or price is derived from the price of. To learn the functions of futures and forwards contracts. The predetermined price of the contract is known as the forward price or delivery price. The specified time in the future when delivery and payment occur is. Differentiate between forward and futures contracts in derivative markets, examining their features, risk profiles, and regulatory supervision to assist. A forward contract on an asset is an agreement between the buyer and seller to exchange cash for the asset at a predetermined price (the forward price) at a. A forward contract is a customized contract between two parties to buy or sell an asset at a specified price on a future date. Learn how to price and value swaps, futures, and forward contracts with CFA Institute. Understand the formulas needed for forward commitment valuation. The value of an OTC futures contract is based on the listed asset's price on the underlying exchange. For forwards, we create prices synthetically, considering.

Unlike forward contracts, futures contracts are marked to market daily. As futures prices change daily cash flows are made, and the contract rewritten in such a. The logic of using a futures contract is very similar to using a forward contract. Both concern transactions of an underlying asset. A Forward Contract. A Futures Contract. Fall c J. Wang. Lecture Notes. Page 5. Forwards and Futures. Chapter Example. Yesterday, you. Both futures and forwards contracts are both financial agreements between two parties to buy or sell an underlying asset at a specified price on a future date. Futures Forward is an interactive camp for 8th–12th grade students that develops an entrepreneurial mindset, leadership skills, and hands-on training. Forwards and futures are largely similar. They both entail an agreement between two parties to buy or sell an asset on a specific date in the future. CHAPTER 7Currency Forwards and Futures Aims To outline contract specifications, settlement procedures and price quotes for selected foreign exchange (FX). • Forward price for an investment asset that provides a known dividend yield. • Valuing forward contracts. • Forward prices and futures prices. • Stock index. Concept Forward Contracts, Futures Contracts, Options (Calls and Puts), Swaps, and Credit Derivatives. Forward contract is an obligation for one party to. A forward contract, also known as forwards, is a private agreement between two parties to purchase or sell the underlying asset at a predetermined time at a. As we said in our previous article, forwards, futures, and swaps are forward commitments. This means they are contracts requiring each party to perform a. Forwards carry both credit and market risk, leaving traders open to counterparty default. Settlement happens upon contract expiration, therefore profits or. Futures contracts are different from forward contracts, which cannot be offset; i.e., if a purchaser buys a forward contract and then sells an identical forward. A Futures Contract is traded over the stock exchange and is regulated by the government. On the other hand, a Forward Contract is directly negotiated between. Pricing Differential. If interest rates were constant, futures and forwards would have the same prices. The pricing differential between the two varies with the. ⇒ This is a forward contract if parties contract directly, a futures contract if they do it through standard contracts that trade in organized derivatives. We shall also consider how forward and future prices are related to spot market prices. Keywords: Arbitrage, Replication, Hedging, Synthetic, Speculator. Professor Shiller elaborates on the difference between forwards and futures and on the role of futures markets to infer future prices for the underlying. ICE Futures US futures contracts are desgined to be flexible and keep our customers ahead of the curve, our trading and risk management solutions include. Futures and forward contracts can be used for speculation, hedging, or to arbitrage between the spot and the deferred-delivery markets. Futures and forward.